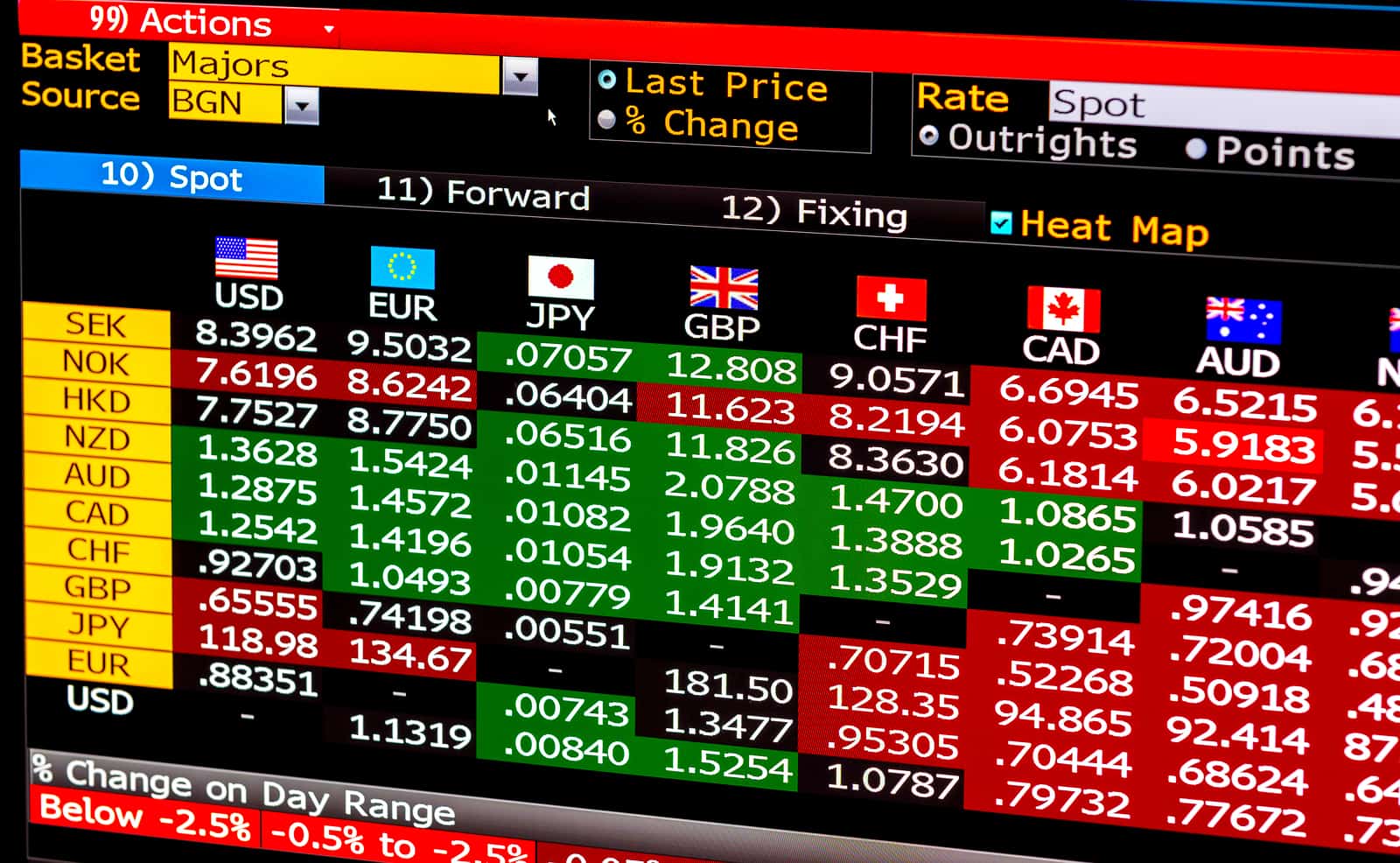

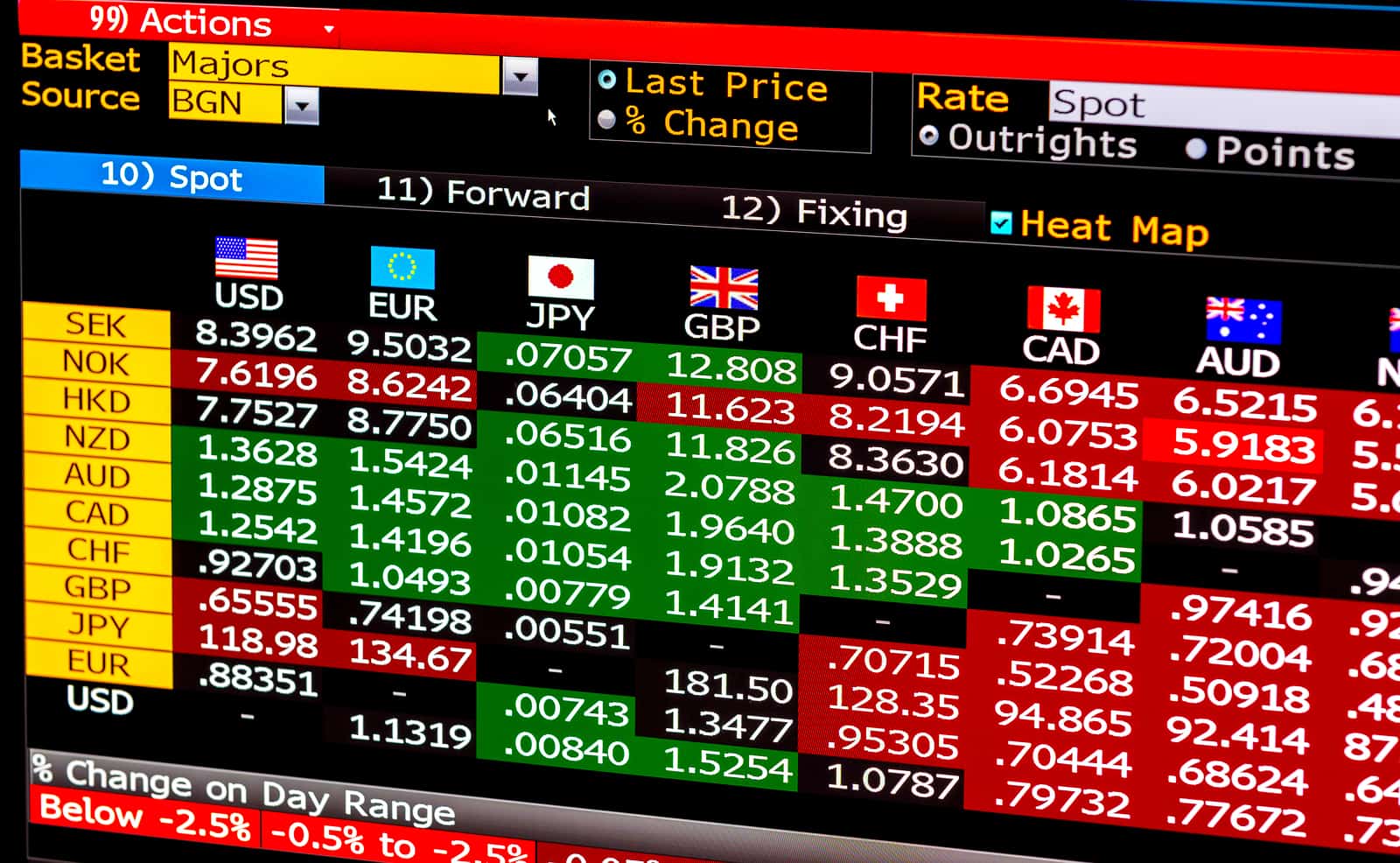

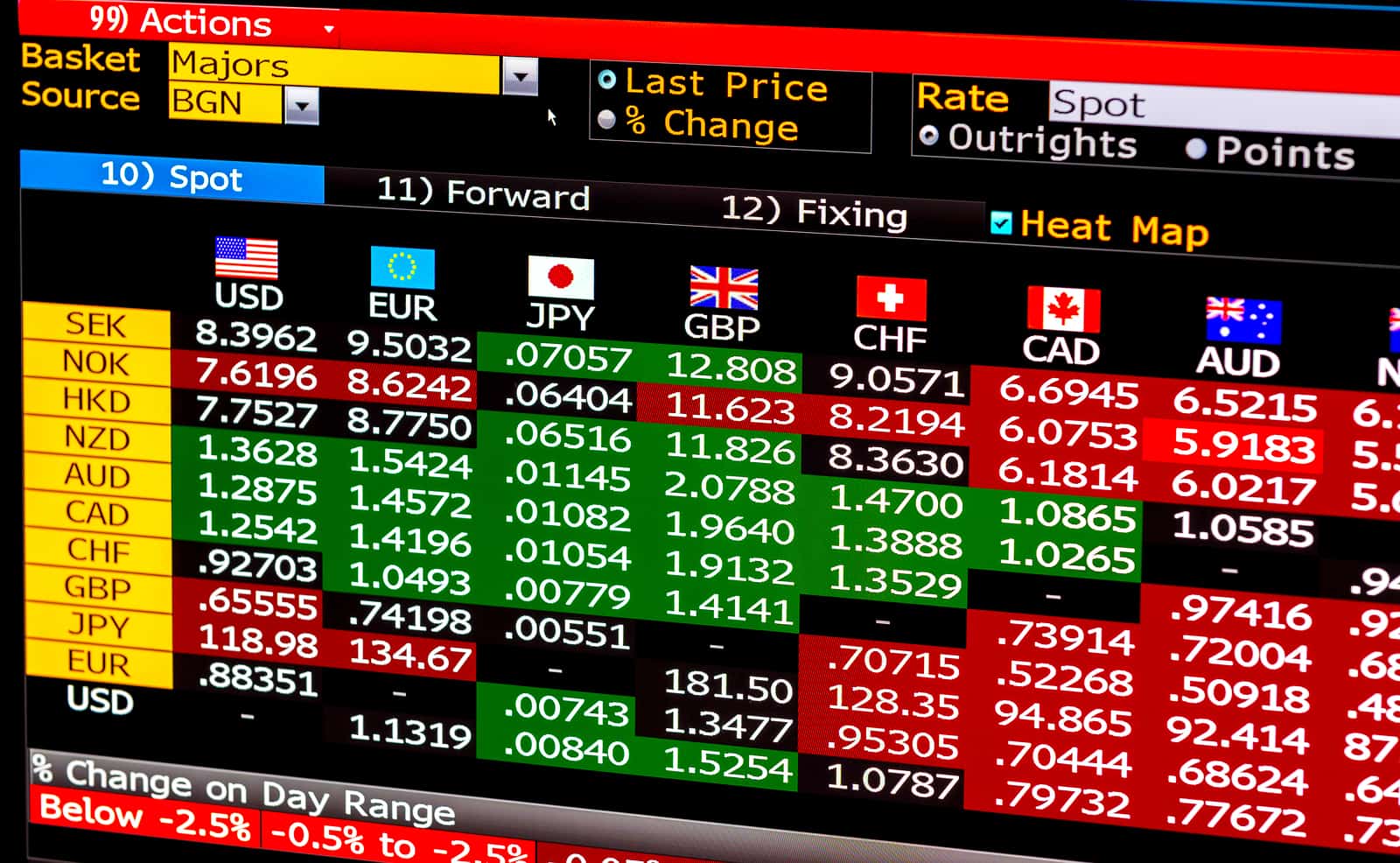

Forex yuan trading