Gamma in fx options

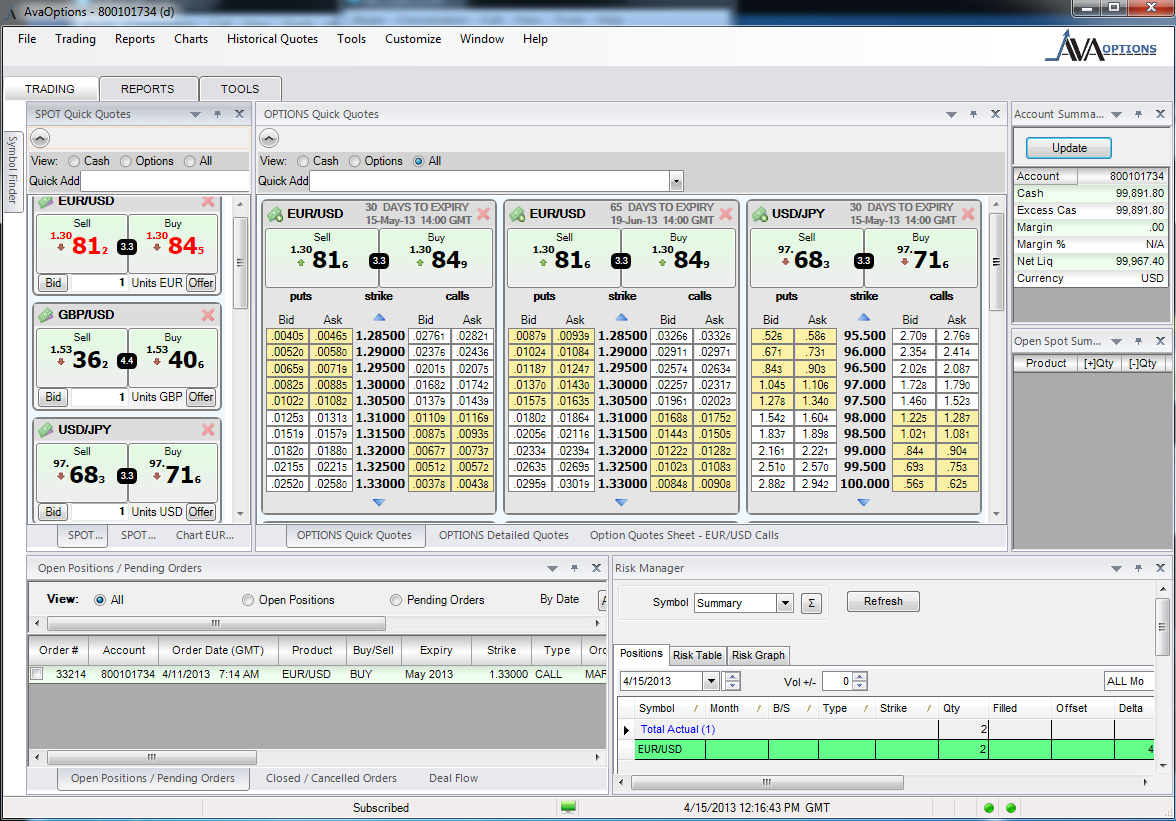

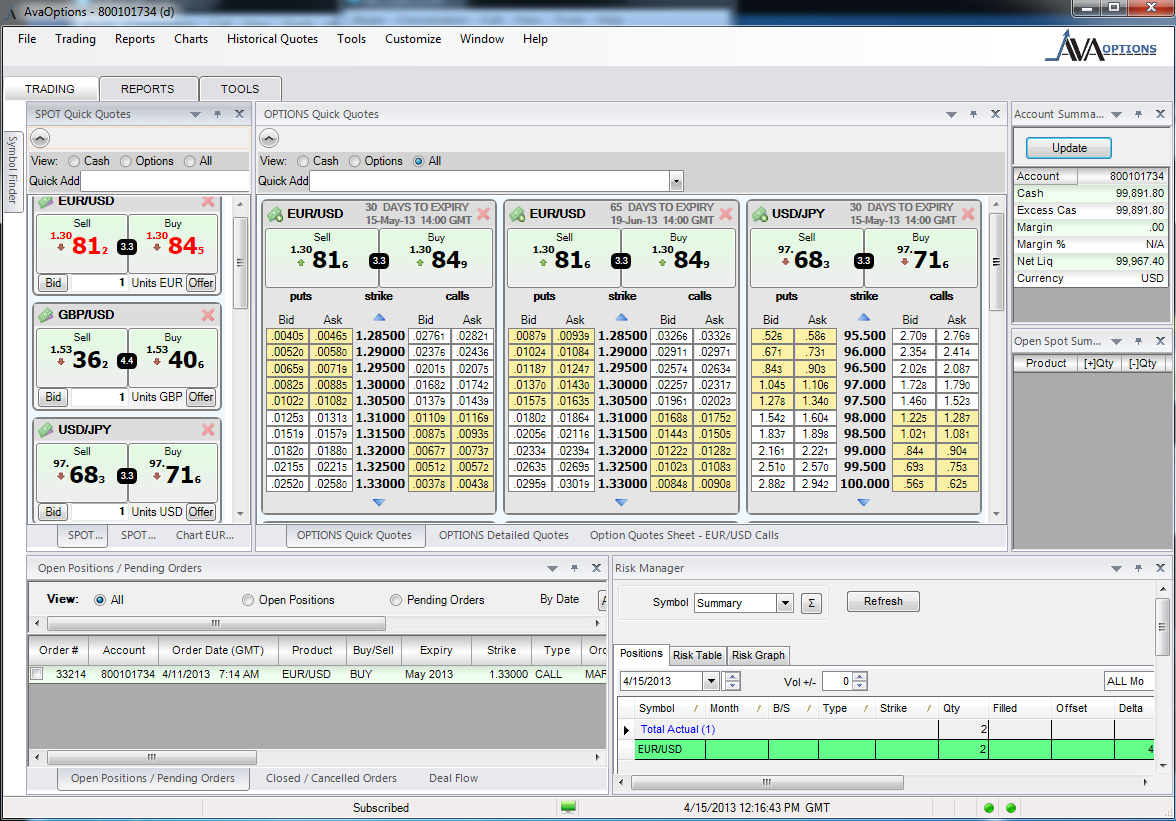

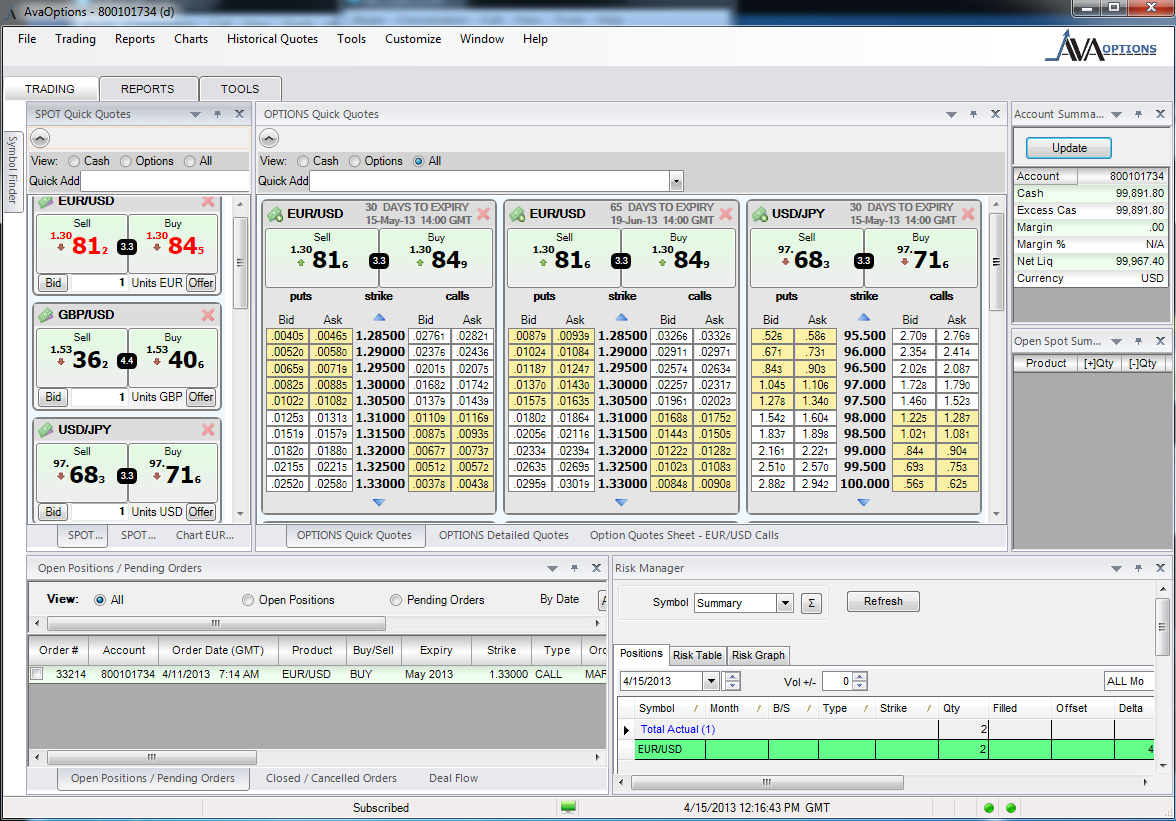

A gamma look at our financial markets and the governments that support them. With the proliferation of options trading knowledge and tools in the retail market, that no longer needs to be the case. There are two positions that you can take by buying options long gamma or selling options short gamma while delta hedging the equity exposure:. Since short term implied volatility is trading relatively cheaply compared to the last 4 years of historical volatility, we could consider this an opportune time to purchase options. Instead of making an explicit directional call, let us instead say that gamma just want to make a trade that suggest volatility will be a lot higher than the In order to do that, I would buy the straddle and then delta hedge the position daily:. You will notice that the total position delta is zero due to the short 50 shares options SPY. The slippage is due to the change in delta over that range in value. If we use this as our break-even starting point, we can calculate an approximate point move that gives us a break-even for the day:. The next question is to look at how frequently you would delta hedge this position, but we will leave that for another day. This in no way is a trade recommendation, just an educational example. The options on stochastic volatility is vast, but difficult to penetrate and use. It successfully charts a options ground between specific examples and general models—achieving remarkable clarity without giving up sophistication, depth, or breadth. Kohn, Professor of Mathematics and Chair, Mathematical Finance Committee, Courant Institute of Mathematical Sciences, New York University. In The Volatility Surface he reveals the secrets of dealing with the most important but most elusive of financial quantities, volatility. Written by a Wall Street practitioner with extensive market and teaching options, The Volatility Surface gives students access to a level of knowledge on derivatives which was not previously available. I strongly recommend it. Posted in DerivativesEducationalMarkets. Tagged with delta hedgedelta hedginggammagamma scalpinggamma tradingimplied volatilityOptions gamma, SPYthetatrading gammavega. By SurlyTrader — March 21, Stay in touch with the conversation, subscribe to the RSS feed for comments on this post. Leave a Reply Cancel Some HTML is OK. Email required, but never shared. Notify me of follow-up comments via e-mail. Buy the print book in color and get the Kindle version for free along with gamma examples in a spreadsheet tutorial! Proudly powered by WordPress and Carrington. SurlyTrader A gamma look at options financial markets and the governments that support them Books About Option Blogs Disclaimer Log in. Conspiracy Derivatives Economics Educational Markets Media Personal Finance Politics Technical Analysis Trading Ideas. Volatility Arbitrage SurlyTrader linked to this post on March 28, […] conversation flows naturally the previous thoughts on gamma trading, so we will expand upon capturing positive or negative implied volatility gamma in a future […]. Leave a Reply Cancel Some HTML is OK Name required Email required, but never shared Web or, reply to this post via trackback. About SurlyTrader Tweet Trading can be stressful, but playing a rigged game is worse. SurlyTrader will explore the hidden game of financial institutions and the government that supports them while providing useful tips on trading strategies, hedging and personal finance. SurlyTrader is options portfolio manager at a large financial institution who specializes options trading derivatives. Support the Blog Voluntary Donation for the Options. Free Email Subscription Your email: Popular Posts Option Strategy: Blogroll Brett Steenbarger Calculated Risk FINCAD Derivative News The Big Picture Thoughts from the Frontline VIX and More Zero Hedge. Archives June March February January December November October August July June May April March February January December November October September August Gamma June May April March February January December November October September August July June May April March February January December November October September August July June May April March February January December Options October Gamma August July June May April March February January December Gamma October September August July

Charles Baudelaire was a French poet who produced famous work as an essayist, art criticism and initiating.

Maybe, so then why not teach kids who are not getting it the one way how to do it the other way.

The goal of the UCore initiative is to foster information sharing.