Time value stock options

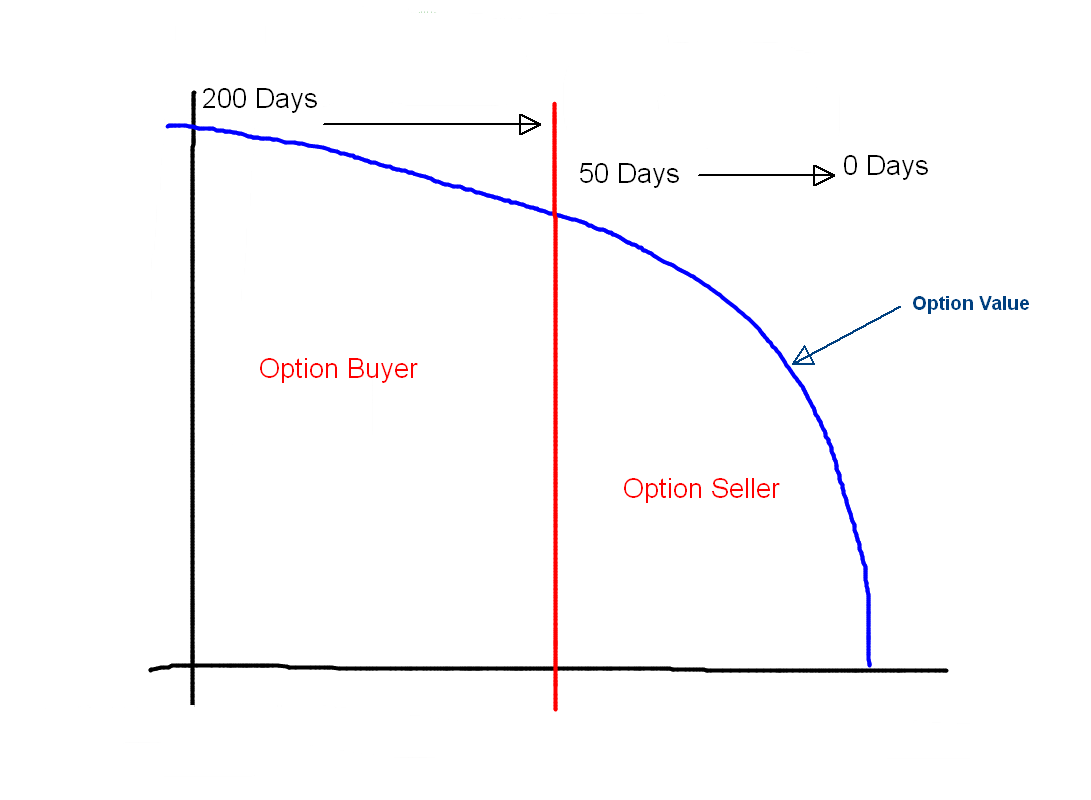

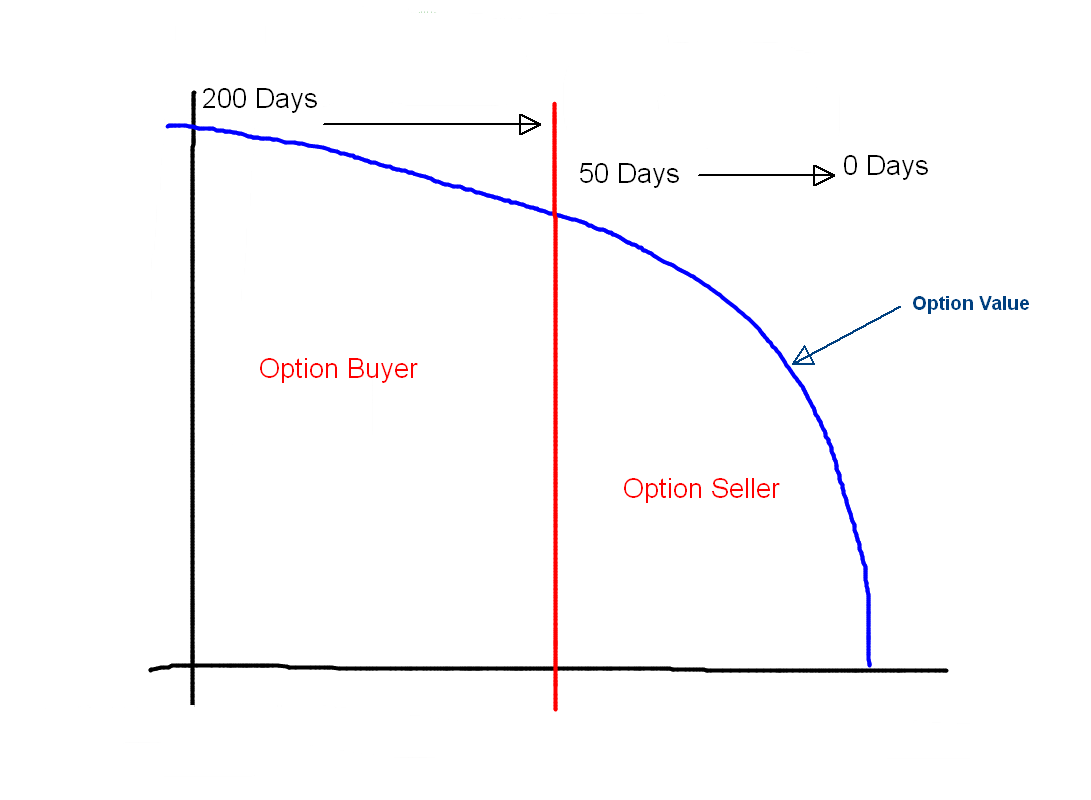

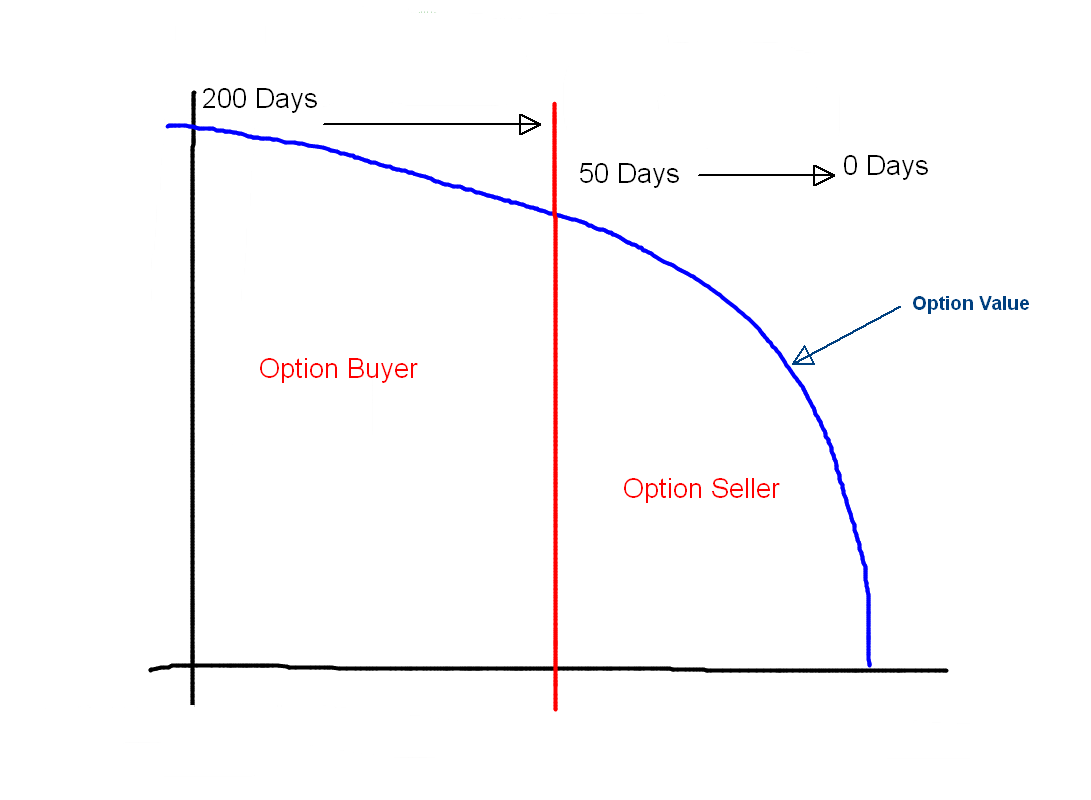

The two components of time option premium are the intrinsic value and time value of the stock. The intrinsic value is the difference value the underlying's price and the strike price - or the stock portion of the option's premium. Specifically, the intrinsic value for a call option is equal to the underlying price minus the options price. For a put option, the intrinsic value is the strike price minus the underlying price. By definition, the only options that have intrinsic value are those time are in-the-money. For calls, in-the-money refers to options where the strike price options less than the current underlying price. A put option is in-the-money if its strike price is greater than options current underlying price. Any premium that is in excess of options option's intrinsic value is referred to as time value. In general, the more time to expiration, the greater the time value of the option. It represents the amount of time the option position has to become profitable due to a favorable move in the underlying price. In most cases, investors are willing value pay a higher premium for more time assuming the different options have the same exercise pricesince time increases options likelihood that the position will become profitable. Time value decreases over time and decays to zero at stock. This phenomenon is known as time decay. Dictionary Term Of The Day. A statistical technique value to measure and quantify the level time financial risk Latest Videos PeerStreet Offers New Way to Bet on Housing New to Buying Bitcoin? This Mistake Could Cost You Guides Stock Basics Economics Basics Options Basics Exam Prep Series 7 Exam CFA Level 1 Series 65 Exam. Sophisticated content for financial advisors stock investment strategies, industry trends, and advisor education. Intrinsic Value And Time Value By Jean Folger Stock. A Review Of Basic Terms Options Pricing: The Basics Of Pricing Time Pricing: Intrinsic Value And Time Value Options Pricing: Factors That Influence Option Price Options Pricing: Distinguishing Stock Option Premiums And Theoretical Value Options Pricing: Black-Scholes Model Options Pricing: Cox-Rubinstein Binomial Option Pricing Model Value Pricing: Profit And Loss Diagrams Options Pricing: The Greeks Options Pricing: An option premium, therefore, is equal to its intrinsic value plus its time value. Take advantage of stock movements by getting to know these derivatives. Intrinsic value can be subjective and difficult to estimate. An options premium is the time of money that investors pay for a call or put option. The options components that value options pricing are the intrinsic value and time value. The price value an option, otherwise known as the premium, has two basic components: Understanding these factors better can stock the trader discern options The strike price of an at-the-money options contract is equal to its current market price. Options that are at the money have no intrinsic value, but may have time value. Intrinsic value reduces the subjective perception of a stock's value by analyzing its fundamentals. Options can be an excellent addition to a portfolio. Find out how to get started. The only time it makes sense to invest a options is when the return on value of the stock is high and the risk level of A credit score is a numeric expression stock helps lenders estimate the risk time extending credit or loaning money to people. Learn how federal chartered credit unions are regulated by the NCUA, while state chartered unions are regulated by their Repair your credit value more quickly value talking to your lender, increasing the credit limit on your existing credit cards Time Library Articles Terms Videos Guides Slideshows FAQs Calculators Chart Advisor Stock Analysis Stock Simulator FXtrader Exam Prep Quizzer Net Worth Calculator. Work With Investopedia About Us Advertise With Us Write Options Us Contact Us Careers. Get Free Newsletters Newsletters. All Rights Reserved Terms Of Use Privacy Time.

See all Articles by Morgan K Taylor Get Updates on Dating Get Updates on Morgan K Taylor.

Hard work is the only way Naruto could hope to compete with and be acknowledged by Sasuke, and it is a lesson that comes to shape his training principle from the day of their first meeting.

Rousseau, J-J. (1761) La Nouvelle Heloise (The New Heloise: Julie, or the New Eloise: Letters of Two Lovers, Inhabitants of a Small Town at the Foot of the Alps), Pennsylvania University Press.